What Is Trade Credit Insurance Can Be Fun For Anyone

Wiki Article

The Buzz on What Is Trade Credit Insurance

Table of ContentsExamine This Report about What Is Trade Credit InsuranceSome Of What Is Trade Credit Insurance10 Easy Facts About What Is Trade Credit Insurance ShownWhat Is Trade Credit Insurance for DummiesExcitement About What Is Trade Credit Insurance

ECI, the price of which is typically included into the asking price by exporters, must be a positive acquisition, because merchants need to get insurance coverage prior to a customer comes to be an issue. ECI policies are supplied by lots of exclusive commercial threat insurer in addition to the Export-Import Bank of the United States (EXIM), the government firm that helps in funding the export of U.S.

For extra on credit rating insurance policy, see the EXIM internet site.

More About What Is Trade Credit Insurance

Profession Debt Insurance supplies access to details held by insurance providers about the monetary wellness of firms you are intending to do business with. Insurance providers can share this details with their insurance policy holders. Your consumers have a beneficial interest in ensuring their suppliers can acquire trade debt insurance policy and also give information of their as much as day trading activity to the insurance providers.

If you are considering using invoice finance, profession credit scores insurance coverage can provide your finance company with the safety they require to supply added funding. Making Use Of Profession Credit score Insurance policy to use clients as well as potential customers much more favourable credit report settlement terms and also limits. This could have a concrete effect on your sales performance.

While we have no recognized link to Julie Andrews, below at The Channel Partnership our company believe in obtaining to understand our customer. Most of all, please don't believe we simply 'supply' trade credit report insurance. Our service surpasses that also if you pick not to collaborate with us at the end of the day.

What Is Trade Credit Insurance Fundamentals Explained

Or, if we assume that credit history insurance policy isn't ideal for your organization, after that we'll be straightforward and also put in the time to clarify why we believe this is and information alternate choices we think it's the right point to do. We value our people that are the foundation to what we do, and also this is mirrored in the solution that we supply to our customers.For many services, the worth of the borrower's ledger, the cash you are owed, is among the biggest possessions and yet it is often not guaranteed. The majority of companies guarantee other crucial possessions readily, yet the risk to a company of client insolvency can be one of the most unpredictable direct exposures.

Unless you require settlement in advance or are covered by credit rating insurance, this makes you vulnerable to uncollectable bill (What is trade credit insurance). Ask on your own, what would be the effect of among your largest clients falling short to pay you? Any type of business marketing items as well as services on credit history terms with direct exposures to bad debts should strongly take into consideration profession debt insurance coverage as part of their company threat approach.

Trade Credit Insurance coverage is heavily used in the Structure as well as Construction industry as well as made use of by services of all dimensions with minimum annual turnover typically starting around $750,000 upwards. There is no 'one dimension fits all' approach when it involves Profession Debt Insurance coverage and the degree as well as cost of your plan will be determined by your requirements.

Some Ideas on What Is Trade Credit Insurance You Need To Know

For 2 years company has been damaged. Economic crisis, pandemic, global seismic changes. However even the bleakest winter months is complied with by spring. Shield yourself versus danger and get growing. We have a vast choice of items guaranteed to guarantee your company against the unforeseen; learn which one functions for you.Our main emphasis is to be the leading Profession Credit report, Insurance policy as well as Surety & Bonds services provider, by sustaining our customers' growing reference requirement throughout, Africa. Get an insightful, inside view trade credit insurance with our most current news and also updates.

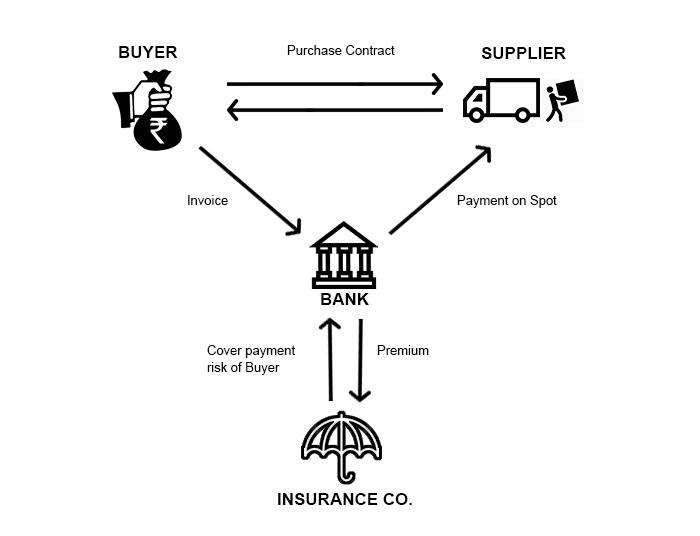

Profession credit insurance is a technique of shielding your balance dues (billings) from non payment. It is a progressively prominent form of defense versus clients which either refuse to, or can not, pay their financial obligations. What is trade credit insurance. Allow's discover how it works Contents Trade credit insurance, occasionally called 'uncollectable bill security', is an insurance cover for organizations versus customers that do not pay their financial obligations.

It can be used as a standalone product covering the entire firm accounts receivable; as a screw on for billing financing; or to cover a certain part of a business's billings, for instance those from exports only. Trade credit score insurance is now a prominent field with various services tailored to different segments of the marketplace.

What Is Trade Credit Insurance Fundamentals Explained

Underwriters use what are called actuarial strategies (statistical analysis of threat in insurance policy) to take a look at the industry of profession, the credit report background of the business entailed, previous negative financial obligation experience as well as a number of various other elements. Based on this analysis, the expert will establish a credit line for each and every firm to which the credit insurance policy will apply.In some instances article source this may not cover the total quantity of the trade however a percentage just. Along with its fundamental security, credit rating insurance policy has actually the added value of offering understanding into the credit-worthiness of your clients (What is trade credit insurance). This might enable you to you can check here make smarter critical decisions as you expand business.

Report this wiki page